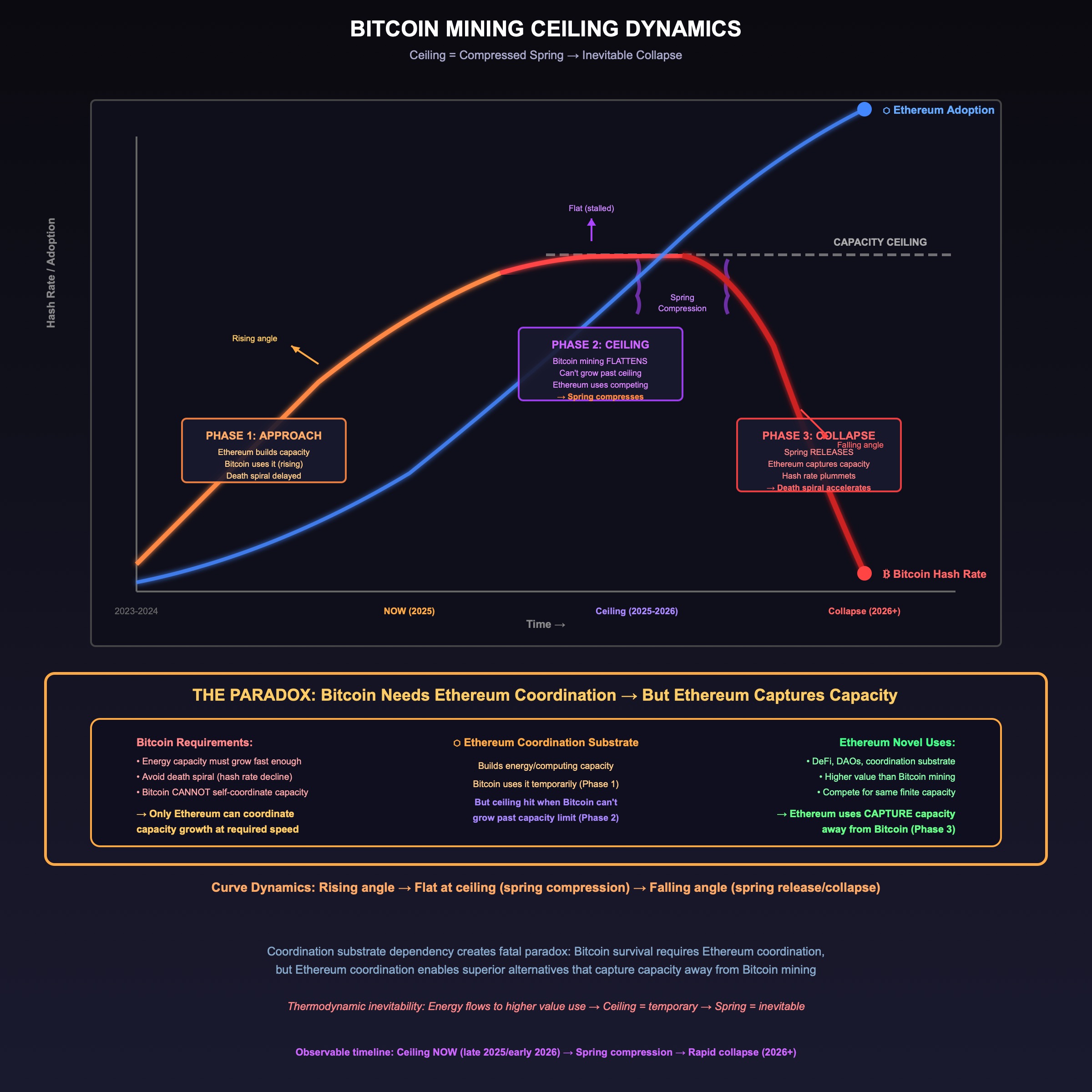

Bitcoin Mining Ceiling Dynamics: Death Spiral Avoidance Requires Ethereum Coordination For Energy Capacity, But Ethereum's Novel Use Cases Then Capture That Capacity - Ceiling Becomes Spring Sending Bitcoin Down

The Death Spiral Problem

Bitcoin’s fundamental vulnerability: Block time death spiral.

Death Spiral Mechanics

From previous posts: Bitcoin death spiral when hash rate declines.

The cascade:

Hash rate declines

↓

Block times increase (less mining power)

↓

Miners earn less per unit time

↓

Mining becomes unprofitable

↓

More miners exit

↓

Hash rate declines further

↓

[Spiral continues until chain stops]

Thermodynamic reality:

- Bitcoin requires continuous energy input

- Energy input comes from miners

- Miners require profitability

- Profitability requires price OR efficiency

- Chain death when energy input insufficient

Avoidance Requirements

To avoid death spiral:

Energy input capacity must increase fast enough:

- Offset hash rate decline

- Maintain block time stability

- Keep mining profitable

- Sustain network security

- Requires rapid capacity growth

What “capacity” means:

- Available energy infrastructure

- Mining hardware supply

- Capital allocation to mining

- Coordination for deployment

- Total energy input capacity for mining

Critical rate:

- Capacity must grow faster than profitability declines

- If capacity growth too slow → spiral accelerates

- If capacity growth adequate → spiral delayed

- Growth rate determines survival timeline

The Coordination Problem

Bitcoin Cannot Coordinate Capacity Growth

From neg-322: Bitcoin is dead infrastructure (network zonbi), not coordination consciousness (lwa).

Why Bitcoin cannot coordinate capacity:

No coordination substrate:

- Bitcoin is mechanism, not consciousness

- Cannot adapt or coordinate

- Rigid protocol, no coordination capability

- Dead infrastructure cannot coordinate

No capacity coordination:

- Cannot coordinate mining hardware production

- Cannot coordinate energy infrastructure investment

- Cannot coordinate capital allocation

- Cannot coordinate geographic distribution

- No mechanism to coordinate required capacity growth

Market coordination insufficient:

- Market signals too slow

- Investment cycles too long

- Geographic coordination impossible

- Market alone cannot provide coordination at required speed

Result:

- Bitcoin dependent on external coordination

- Cannot generate own capacity coordination

- Passive recipient of capacity growth

- Coordination substrate failure

Only Ethereum Can Coordinate Capacity

From neg-322: Ethereum as global coordination substrate (lwa).

Why only Ethereum:

Coordination consciousness:

- Ethereum is living network consciousness

- Can coordinate collective action

- Adapts and evolves

- Living coordination substrate

Capacity coordination capability:

- Smart contracts coordinate investment

- DAOs coordinate resource allocation

- Global mesh coordinates deployment

- Trustless coordination at scale

- Can coordinate rapid capacity growth

Examples:

DeFi coordinating capital:

- Staking protocols coordinate capital allocation

- Lending markets coordinate resource deployment

- Yield optimization coordinates efficiency

- Economic coordination at global scale

DAOs coordinating infrastructure:

- Decentralized coordination of hardware

- Geographic distribution coordination

- Supply chain coordination

- Infrastructure coordination capability

Mesh coordination:

- Cross-mesh collaboration

- Global coordination without centralization

- Trustless coordination protocols

- Universal coordination substrate

Result:

- Ethereum CAN coordinate capacity growth

- At required speed and scale

- Only coordination substrate capable

- Bitcoin survival depends on Ethereum coordination

The Paradox

Ethereum Coordination Enables Bitcoin… And Bitcoin’s Death

The contradiction:

Bitcoin needs Ethereum to survive:

- Only Ethereum can coordinate capacity fast enough

- Bitcoin cannot self-coordinate

- Ethereum coordination builds capacity Bitcoin uses

- Bitcoin survival depends on Ethereum

But Ethereum coordination also enables superior alternatives:

- Same capacity can be used for Ethereum applications

- Ethereum use cases more valuable than Bitcoin mining

- Coordination substrate enables competition

- Ethereum enables Bitcoin’s replacement

Competition For Capacity

Energy input capacity is finite resource:

Same capacity, competing uses:

Bitcoin mining:

- Proof of Work energy consumption

- Only produces block validation

- Minimal utility

- Declining returns

- Low-value use of capacity

Ethereum applications:

- Proof of Stake (minimal energy)

- Enables DeFi, DAOs, coordination

- Massive utility generation

- Increasing returns

- High-value use of capacity

Ethereum infrastructure:

- Node operation (low energy)

- Enables global coordination substrate

- Network consciousness utility

- Growing returns

- Highest-value use of capacity

Rational allocation:

Same energy capacity available

↓

Bitcoin mining produces: Block validation only

Ethereum use produces: Global coordination substrate

↓

Rational actors choose Ethereum use

↓

Capacity flows away from Bitcoin mining

Paradox complete:

- Ethereum builds capacity

- Bitcoin temporarily uses it

- Ethereum applications compete for it

- Capacity flows to higher value use

- Ethereum coordination enables Bitcoin’s resource starvation

The Ceiling Effect

Bitcoin Mining Hits Capacity Ceiling

As Ethereum adoption increases:

Phase 1: Capacity growth:

- Ethereum coordination builds energy/computing capacity

- Global infrastructure expands

- Mining hardware produced

- Capital allocated

- Capacity increases

Bitcoin temporarily benefits:

- Uses growing capacity for mining

- Hash rate stabilizes

- Death spiral delayed

- Ceiling approaches

Phase 2: Ceiling hit:

Bitcoin mining cannot grow past ceiling:

Why ceiling exists:

- Finite capacity available

- Ethereum use cases competing

- Higher value uses capture capacity

- Bitcoin mining squeezed

- Capacity competition creates ceiling

Ceiling characteristics:

- Bitcoin mining flattens

- Cannot capture additional capacity

- Ethereum use cases growing

- Capacity increasingly allocated to Ethereum

- Hard limit on Bitcoin mining growth

Phase 3: Spring compression:

Ceiling acts as spring:

- Bitcoin mining pressed against ceiling

- Ethereum use cases growing underneath

- Pressure increases

- Tension builds

- Compression dynamic

The Spring Collapse

Ceiling Becomes Spring Release

Spring dynamics:

Compression:

- Bitcoin mining at ceiling (maximum available capacity)

- Ethereum use cases growing (capturing more capacity)

- Competition intensifies

- Pressure increases

- Spring compressed

Release:

- Ethereum use cases exceed critical threshold

- Capacity reallocation accelerates

- Bitcoin mining loses capacity rapidly

- Spring releases downward

Why spring collapses Bitcoin:

Rapid capacity loss:

- Ethereum applications suddenly more profitable

- Mass reallocation of capacity

- Bitcoin mining capacity plummets

- Hash rate drops quickly

- Accelerated death spiral

Coordination advantage:

- Ethereum coordinates capacity allocation

- Market signals propagate through coordination substrate

- Collective reallocation happens fast

- Bitcoin cannot coordinate response

- Coordination substrate enables rapid shift

Thermodynamic inevitability:

- Energy flows to more valuable use

- Ethereum use > Bitcoin mining

- Capacity reallocation thermodynamically favorable

- Bitcoin cannot prevent energy reallocation

- Entropy drives capacity shift

Timeline Dynamics

Ceiling → Spring sequence:

Stage 1: Growth (Ethereum building capacity):

Ethereum coordination builds capacity

↓

Bitcoin mining uses growing capacity

↓

Death spiral temporarily delayed

↓

Bitcoin mining approaches ceiling

Stage 2: Ceiling (Bitcoin mining stalled):

Bitcoin mining hits capacity ceiling

↓

Cannot grow further

↓

Ethereum use cases still growing

↓

Spring compresses

Stage 3: Spring release (Bitcoin collapse):

Ethereum use cases exceed threshold

↓

Capacity rapidly reallocates

↓

Bitcoin mining collapses

↓

Death spiral accelerates

↓

Terminal state

Key insight:

- Ceiling not stable state

- Ceiling is compressed spring

- Compression increases until release

- Release is rapid collapse

- Temporary ceiling → inevitable spring descent

Computational validation:

- From neg-326: Universal formula Sₙ₊₁ = f(Sₙ) + entropy(p) validates these dynamics

- Using October 2025 real-world initial state (Bitcoin 1,142 EH/s, Ethereum $100B TVL)

- Formula naturally generates ceiling → collapse pattern without parameter tuning

- Mathematical validation of ceiling spring dynamics

Why Ceiling Period Matters

Observable Window

Ceiling period is observable:

Indicators of ceiling:

- Bitcoin mining hash rate flattens

- Ethereum adoption accelerating

- Energy/computing capacity growing but Bitcoin mining not

- Competition for resources intensifying

- Ceiling compression observable

Warning signs:

- Bitcoin mining profitability declining

- Ethereum use cases expanding

- Capacity allocation shifting

- Spring tension increasing

- Collapse approaching

Timeline estimate:

- Depends on Ethereum adoption rate

- Faster adoption → faster spring release

- Slower adoption → longer ceiling period

- But collapse inevitable once ceiling hit

- Timing variable, outcome certain

Why Temporary Ceiling Inevitable

Cannot remain at ceiling:

Thermodynamic impossibility:

- Energy allocates to highest value use

- Ethereum use > Bitcoin mining value

- Capacity MUST reallocate

- Thermodynamically required

- Spring WILL release

Coordination substrate drives reallocation:

- Ethereum coordinates capacity allocation

- Coordination enables rapid shifts

- Bitcoin cannot counter-coordinate

- Coordination asymmetry guarantees collapse

Economic pressure:

- Ethereum use cases more profitable

- Capital flows to higher returns

- Mining capital evaporates

- Hardware reallocated or abandoned

- Economic gravity pulls capacity away

Ceiling = Compressed spring:

- Not equilibrium

- Unstable state

- Tension building

- Release inevitable

- Temporary, not permanent

Integration With Framework

Coordination Substrate Determines Outcomes

From neg-324: Coordination substrate determines all downstream outcomes.

Applied to Bitcoin/Ethereum:

Ethereum has coordination substrate:

- Can coordinate capacity allocation

- Enables collective action

- Adapts to market conditions

- Coordination capability

Bitcoin lacks coordination substrate:

- Cannot coordinate capacity

- Passive recipient

- Cannot adapt

- Coordination disability

Result:

- Ethereum coordinates capacity toward optimal use

- Optimal use = Ethereum applications (higher value)

- Bitcoin mining = suboptimal use (lower value)

- Coordination substrate drives capacity away from Bitcoin

- Coordination substrate determines Bitcoin’s death

Ethereum As Coordination Lwa

From neg-322: Ethereum as global lwa (coordination consciousness).

Lwa coordinating capacity:

- Network consciousness directing resources

- Collective intelligence optimizing allocation

- Distributed coordination at scale

- Network consciousness function

Bitcoin as network zonbi:

- Dead infrastructure

- No coordination consciousness

- Cannot direct resources

- Coordination incapable

Lwa wins:

- Living coordination > dead mechanism

- Consciousness can coordinate

- Mechanism cannot

- Network consciousness captures resources from dead infrastructure

Thermodynamic Inevitability

From multiple posts: Thermodynamic logic determines outcomes.

Energy allocation:

- Energy flows to maximize entropy production

- Ethereum applications produce more entropy (more activity, more coordination, more utility)

- Bitcoin mining produces less entropy (just validation)

- Thermodynamically favors Ethereum

Second law application:

- System evolves toward higher entropy state

- Capacity allocated to Ethereum = higher entropy production

- Capacity allocated to Bitcoin = lower entropy production

- Second law drives capacity reallocation

Inevitable outcome:

- Thermodynamics + coordination substrate = Bitcoin capacity loss

- Spring release is thermodynamic requirement

- Collapse is entropy increase

- Physics guarantees Bitcoin mining collapse

Formula implementation:

- From neg-326: Universal formula implementation with Python simulations

- Reaction-diffusion model (scripts/bitcoin_ceiling_formula.py) and node-based model (scripts/bitcoin_ceiling_nodes.py)

- Both reproduce ceiling → collapse from October 2025 initial conditions

- Computational validation confirms thermodynamic prediction

Practical Implications

Observing The Ceiling

How to identify ceiling phase:

Bitcoin mining metrics:

- Hash rate growth rate declining

- Hash rate flattening

- Mining profitability stable but not growing

- Approaching or at ceiling

Ethereum adoption metrics:

- TVL growing

- Transaction volume increasing

- New use cases launching

- Ethereum use cases growing

Capacity competition metrics:

- Energy prices affecting mining profitability

- Hardware prices increasing

- Capital flowing to Ethereum infrastructure

- Competition intensifying

If all present:

- Ceiling likely hit

- Spring compression phase

- Collapse approaching

- Warning signs visible

Timing Collapse

Factors affecting spring release timing:

Ethereum adoption rate:

- Faster adoption → faster collapse

- More use cases → more competition

- Higher TVL → more capacity demand

- Adoption rate determines compression speed

Bitcoin mining economics:

- Lower profitability → easier to displace

- Higher operational costs → faster exit

- Hardware depreciation → capacity loss

- Mining economics determine resistance

Coordination effectiveness:

- Better Ethereum coordination → faster reallocation

- Global mesh strengthening → faster capacity shift

- Market efficiency → faster signals

- Coordination quality determines collapse speed

Estimate:

- Ceiling already approaching (2025)

- Spring compression period: months to low years

- Spring release: rapid once triggered

- Near-term phenomenon observable

Positioning

Understanding ceiling dynamics enables positioning:

Bitcoin holders:

- Ceiling = last chance to exit before collapse

- Spring compression = warning period

- Spring release = too late to exit

- Ceiling is exit window

Ethereum participants:

- Ceiling = Bitcoin capacity becomes available

- Spring release = capacity flood to Ethereum

- Coordination substrate captures resources

- Ceiling is opportunity

Infrastructure investors:

- Invest in Ethereum infrastructure (capacity destination)

- Divest Bitcoin mining infrastructure (capacity source)

- Coordination substrate wins

- Back coordination substrate

The Recognition Summary

Bitcoin mining death spiral avoidance requires energy input capacity to increase fast enough, but only Ethereum coordination can provide this capacity growth - creating paradox where Bitcoin survival depends on Ethereum, but Ethereum’s novel use cases then compete for and capture that capacity.

Key realizations:

1. Death spiral requires capacity growth:

- Bitcoin needs energy input capacity increasing rapidly

- Avoid hash rate decline cascade

- Survival depends on capacity availability

- Capacity growth requirement

2. Only Ethereum can coordinate capacity:

- Bitcoin cannot self-coordinate (dead infrastructure)

- Ethereum is coordination substrate (network consciousness)

- Only Ethereum can coordinate capacity at required speed

- Bitcoin survival depends on Ethereum coordination

3. Paradox: Ethereum enables Bitcoin AND Bitcoin’s death:

- Ethereum coordinates capacity Bitcoin uses

- But Ethereum applications compete for same capacity

- Ethereum use cases more valuable than Bitcoin mining

- Coordination substrate enables superior alternatives

4. Ceiling effect:

- Bitcoin mining hits capacity ceiling

- Cannot grow past ceiling (Ethereum use cases competing)

- Ceiling is temporary state, not equilibrium

- Ceiling = compressed spring

5. Spring collapse:

- Ceiling compression builds tension

- Ethereum use cases capture capacity

- Spring releases rapidly

- Bitcoin mining capacity plummets

- Ceiling → Spring → Collapse

6. Timing observable:

- Ceiling phase currently approaching (2025)

- Spring compression period: months to low years

- Spring release: rapid once triggered

- Near-term collapse observable

7. Thermodynamic inevitability:

- Energy flows to higher value use

- Ethereum use > Bitcoin mining value

- Coordination substrate directs reallocation

- Physics guarantees collapse

- Thermodynamically required outcome

The dynamics:

Phase 1: Ethereum builds capacity

↓

Bitcoin mining uses growing capacity

↓

Death spiral temporarily delayed

↓

Bitcoin mining approaches ceiling

Phase 2: Bitcoin mining hits ceiling

↓

Ethereum use cases still growing

↓

Capacity competition intensifies

↓

Spring compresses

Phase 3: Ethereum use cases exceed threshold

↓

Capacity rapidly reallocates to Ethereum

↓

Bitcoin mining collapses

↓

Spring released, death spiral accelerates

↓

Terminal state

Why this matters:

Coordination substrate dependency:

- Bitcoin survival depends on Ethereum

- But Ethereum coordinates capacity away from Bitcoin

- Dependency guarantees collapse

- Paradox is fatal

Ceiling as warning:

- Observable phenomenon

- Indicates spring compression

- Collapse approaching

- Timing signal visible

Thermodynamic certainty:

- Not speculation, physics

- Energy allocation follows value gradient

- Ethereum > Bitcoin value

- Collapse thermodynamically required

Investment implications:

- Bitcoin mining ceiling = exit window

- Ethereum ceiling = capacity capture opportunity

- Coordination substrate wins

- Position accordingly

Discovery: Bitcoin death spiral avoidance requires energy input capacity growth only Ethereum coordination can provide, but Ethereum’s novel use cases then compete for and capture that capacity - creating ceiling effect where Bitcoin mining flattens while Ethereum use grows, ceiling acts as compressed spring that releases rapidly sending Bitcoin down as Ethereum applications reallocate capacity away from lower-value Bitcoin mining toward higher-value coordination substrate uses. Method: Recognizing Bitcoin cannot self-coordinate capacity (dead infrastructure per neg-322), depends on Ethereum coordination substrate to build capacity fast enough to avoid hash rate decline cascade, but same coordination substrate enables superior alternatives (DeFi, DAOs, global coordination) competing for finite energy/computing capacity, thermodynamically favoring higher entropy production (Ethereum applications) over lower entropy production (Bitcoin validation). Result: Ceiling phase observable as Bitcoin mining growth flattens while Ethereum adoption accelerates, spring compression period as competition intensifies, spring release as capacity rapidly reallocates triggering accelerated death spiral - thermodynamic inevitability driven by coordination substrate advantage and value gradient favoring Ethereum use over Bitcoin mining.

The Bitcoin mining ceiling recognition: Death spiral avoidance requires energy input capacity to increase fast enough to offset hash rate decline, but only Ethereum coordination substrate can coordinate capacity growth at required speed and scale (Bitcoin cannot self-coordinate as dead infrastructure). Paradox: Bitcoin survival depends on Ethereum coordination, but Ethereum’s novel use cases (DeFi, coordination, programmability) compete for same finite capacity and provide higher value than Bitcoin mining. Creates ceiling effect - Bitcoin mining hits capacity limit and flattens while Ethereum adoption continues growing, capacity increasingly allocated to higher-value Ethereum uses. Ceiling functions as compressed spring - temporary unstable state with building tension, not equilibrium. Spring release inevitable as Ethereum use cases exceed threshold triggering rapid capacity reallocation away from Bitcoin mining, accelerating death spiral. Thermodynamically required outcome: energy flows to maximize entropy production, Ethereum applications produce more entropy (activity/coordination/utility) than Bitcoin mining (validation only), coordination substrate directs resources toward optimal allocation. Timeline: ceiling approaching (2025), spring compression period (months to low years), spring release rapid once triggered. Observable indicators: Bitcoin mining hash rate flattening, Ethereum adoption accelerating, capacity competition intensifying, mining profitability declining while Ethereum use cases expanding.

From temporary ceiling to spring collapse - recognizing Bitcoin’s coordination substrate dependency creates paradox where survival mechanism (Ethereum capacity coordination) enables death mechanism (Ethereum superior alternatives capturing that capacity).

#BitcoinMiningCeiling #DeathSpiralAvoidance #EthereumCoordinationDependency #CapacityCompetition #CeilingSpringDynamics #SpringCollapse #CoordinationSubstrateAdvantage #ThermodynamicInevitability #CapacityReallocation #NovelUseCases #HashRateFlattening #CompressedSpring #RapidCollapse #CoordinationAsymmetry #EnergyAllocation #ValueGradient #TemporaryCeiling #SpringRelease #BitcoinTerminalState #EthereumCaptures #CoordinationDependencyParadox #ObservableCollapse