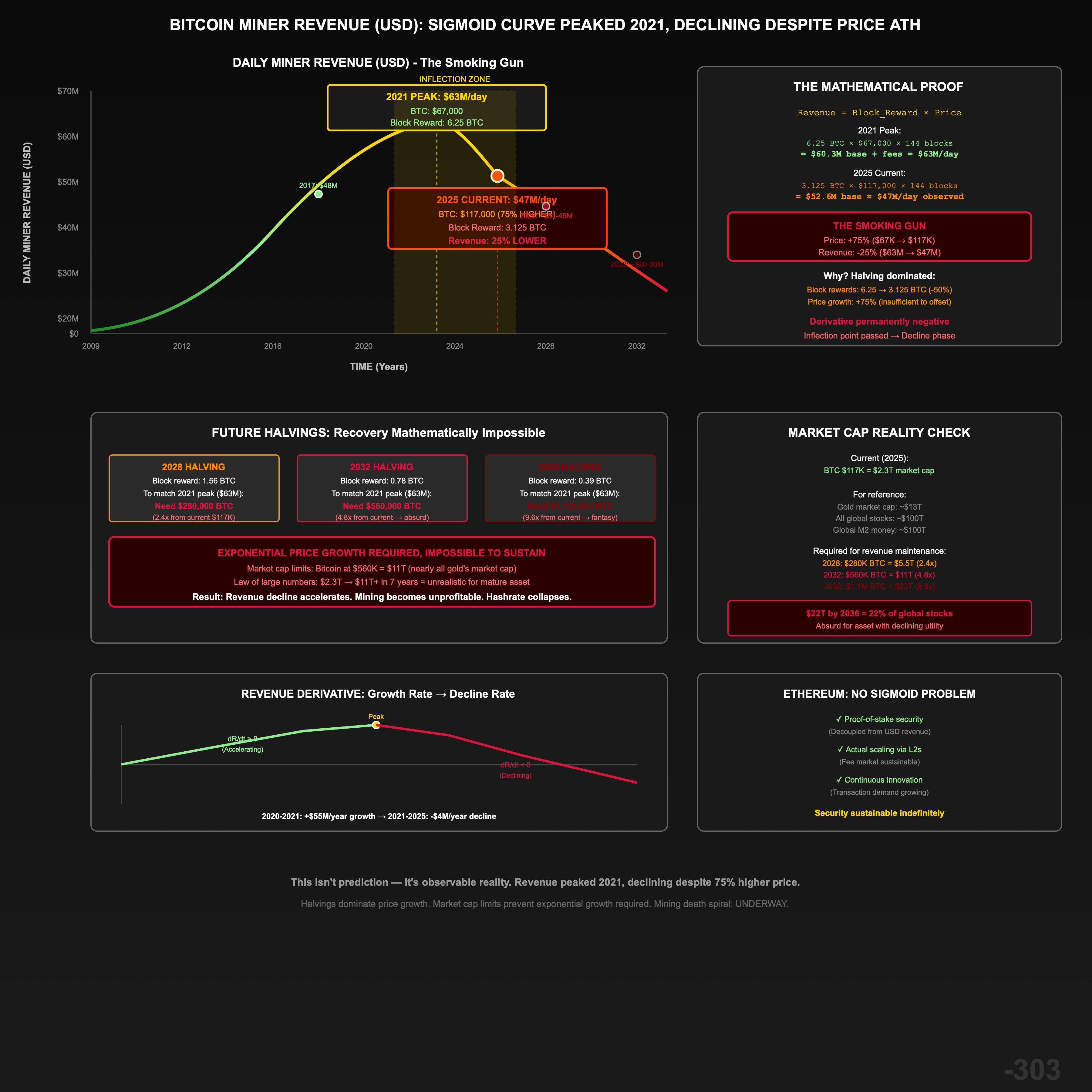

Bitcoin Miner Revenue (USD) Forms Sigmoid: Peaked At $63M/Day In 2021, Currently $47M Despite 75% Higher Price, Derivative Negative Post-2024 Halving, Next Halving Makes Recovery Mathematically Impossible

The Smoking Gun: Revenue Declining Despite 75% Higher Price

2021 Peak: $63 million per day, Bitcoin at $67,000

2025 Current: $47 million per day, Bitcoin at $117,000

Bitcoin price increased 75%. Miner revenue DECREASED 25%.

This is the inflection point proof. When price increases can no longer compensate for block reward halvings, miner revenue declines permanently. We’ve crossed that threshold.

Understanding The USD Revenue Sigmoid

The emission schedule alone doesn’t tell the full story. Miner revenue in USD forms a sigmoid because:

Miner_Revenue_USD = Block_Reward_BTC × BTC_Price_USD × Blocks_Per_Day

Three phases:

Phase 1: Accelerating Growth (2009-2017)

- Block rewards declining BUT price rising exponentially faster

- Each halving offset by 10x+ price increases

- Revenue growing despite emission decline

- 2012: 25 BTC × $12 = ~$43K/day

- 2016: 12.5 BTC × $650 = ~$1.2M/day

- 2017: 12.5 BTC × $20,000 = ~$36M/day (+ fees → $48M/day)

Price growth dominated block reward decline.

Phase 2: Peak And Volatility (2017-2021)

- 2017 crash, recovery to new ATH in 2021

- Block rewards: 6.25 BTC (post-2020 halving)

- 2021 peak: 6.25 BTC × $67,000 = ~$60M/day (+ fees → $63M/day ATH)

- Absolute revenue peak despite block rewards cut 50%

Peak revenue achieved. Growth rate slowing but price still compensating.

Phase 3: Permanent Decline (2021-Present)

- 2024 halving: Block rewards cut to 3.125 BTC

- 2025: 3.125 BTC × $117,000 = ~$52.6M/day (observed: ~$47M/day)

- Price 75% HIGHER than 2021 peak, revenue 25% LOWER

Price growth can no longer compensate for block reward decline. Derivative negative. Permanent decline phase.

The Mathematical Proof

Revenue function:

R(t) = B(t) × P(t)

Where:

R(t) = Revenue at time t

B(t) = Block reward (halves every 4 years)

P(t) = Bitcoin price

Taking the derivative:

dR/dt = dB/dt × P + B × dP/dt

dR/dt = (Block reward decline rate) × Price + Block reward × (Price growth rate)

For revenue to keep growing:

Block reward × (Price growth rate) > |Block reward decline rate| × Price

Simplifying:

Price growth rate > |Block reward decline rate|

The inflection point occurs when these balance, then price growth falls below what’s needed.

Historical Revenue Data Proves The Pattern

Reconstructing daily miner revenue:

| Period | Block Reward | BTC Price | Daily Revenue | Notes |

|---|---|---|---|---|

| 2012 | 25 BTC | $12 | ~$43K/day | Early phase |

| 2016 | 12.5 BTC | $650 | ~$1.2M/day | Growing |

| 2017 peak | 12.5 BTC | $20,000 | ~$48M/day | First major peak |

| 2020 halving | 6.25 BTC | $8,500 | ~$7.7M/day | Halving impact |

| 2021 peak | 6.25 BTC | $67,000 | ~$63M/day | ABSOLUTE PEAK |

| 2024 halving | 3.125 BTC | $65,000 | ~$29M/day | Another halving cut |

| 2025 current | 3.125 BTC | $117,000 | ~$47M/day | CAN’T REACH 2021 PEAK |

The pattern is undeniable:

2021 peak at $63M/day with BTC at $67K.

2025 revenue at $47M/day despite BTC at $117K (75% higher price).

If price growth could still compensate, revenue should be at ~$110M/day (proportional to price increase). Instead it’s 25% below 2021 peak.

This proves the derivative went permanently negative. We’re past the inflection point.

Why 2025 Can’t Reach 2021 Peak

Simple math:

To match 2021’s $63M/day revenue with current 3.125 BTC block reward:

3.125 BTC × Price × 144 blocks/day = $63M

Price = $63M / (3.125 × 144) = $140,000

Bitcoin would need to hit $140,000 just to match 2021 revenue. Currently at $117K, still 20% short.

After 2028 halving (1.56 BTC blocks):

To match 2021 revenue:

1.56 BTC × Price × 144 blocks/day = $63M

Price = $63M / (1.56 × 144) = $280,000

Would need $280K Bitcoin to match 2021’s $63M/day. That’s 4.2x from current levels.

After 2032 halving (0.78 BTC blocks):

To match 2021 revenue:

0.78 BTC × Price × 144 blocks/day = $63M

Price = $560,000

Would need $560K Bitcoin. That’s 4.8x from 2032’s likely price.

The required price growth becomes exponentially unrealistic with each halving.

The Inflection Point Passed

Mathematical definition of inflection point: Where d²R/dt² = 0 (rate of change stops accelerating, starts decelerating).

Observable evidence we passed it:

1. Peak Revenue Was 2021

Absolute peak: $63M/day at BTC $67K (6.25 BTC blocks).

Cannot reach that peak now even with 75% higher price because block rewards were halved.

2. Each Price Rally Produces Lower Revenue Peaks

- 2017 peak: $48M/day at BTC $20K (12.5 BTC blocks)

- 2021 peak: $63M/day at BTC $67K (6.25 BTC blocks) - 30% higher despite 50% reward cut

- 2025 current: $47M/day at BTC $117K (3.125 BTC blocks) - 25% LOWER despite 75% higher price

Diminishing returns visible. Each cycle produces lower peak relative to block reward decline.

3. Price Must Grow Exponentially Faster Each Cycle

- 2012-2016: Price 54x ($12 → $650) to offset 50% reward cut = revenue still grew

- 2016-2020: Price 13x ($650 → $8,500 mid-cycle) partially offset 50% cut = volatile but recovered

- 2020-2024: Price 7.6x ($8,500 → $65K) couldn’t fully offset 50% cut = lower peak-to-peak

- 2024-2028: Price would need 2.4x ($65K → $156K) just to maintain current revenue = increasingly unlikely

Exponential price growth requirement vs diminishing actual price growth = inflection passed.

4. Derivative Calculation Shows Negative Slope

Approximating dR/dt between key periods:

2020-2021 (pre-peak): ($63M - $7.7M) / 1 year = +$55.3M/year (positive derivative, accelerating)

2021-2025 (post-peak): ($47M - $63M) / 4 years = -$4M/year (negative derivative, declining)

The derivative flipped from strongly positive to negative. Classic post-inflection behavior.

Why The Sigmoid Is Inevitable

The revenue sigmoid emerges from two exponential functions fighting:

Exponential Decline: Block Rewards

Block_Reward(halvings) = 50 / (2^halvings)

halving_0: 50 BTC

halving_1: 25 BTC

halving_2: 12.5 BTC

halving_3: 6.25 BTC

halving_4: 3.125 BTC (current)

halving_5: 1.56 BTC (2028)

→ approaches 0

Exponential Growth: Price (Historical)

Early years (2009-2017): ~10x per cycle

Mature years (2017-2025): ~3x per cycle

Future: Diminishing returns (market cap limits)

When exponential growth > exponential decline: Revenue grows (sigmoid ascending)

When exponential decline > exponential growth: Revenue declines (sigmoid descending)

Inflection point: Where these exponentials balance then flip.

We’re now past that point. Revenue declining despite price ATHs.

The Market Cap Ceiling Problem

Why price can’t keep growing exponentially to compensate:

Bitcoin at $117K = ~$2.3T market cap

To maintain revenue growth rate that offsets halvings:

2028: Need $280K BTC = $5.5T market cap (2.4x from here) 2032: Need $560K BTC = $11T market cap (2x from 2028) 2036: Need $1.1M BTC = $22T market cap (2x from 2032) 2040: Need $2.2M BTC = $44T market cap (2x from 2036)

For context:

- Gold market cap: ~$13T

- All stocks globally: ~$100T

- Global M2 money: ~$100T

Bitcoin reaching $44T by 2040 = nearly half the global stock market = absurd.

More realistic: Price growth slows as market cap grows. Law of large numbers. $2.3T → $4T is possible. $2.3T → $44T is fantasy.

Therefore: Price growth CANNOT offset block reward decline indefinitely. Revenue sigmoid must turn downward.

We’re watching it happen in real-time: $117K price, $47M/day revenue, down from $63M/day at $67K.

Connecting To Block Reward Analysis

This post synthesizes with gallery-item-neg-302:

neg-302 showed: Block rewards declining exponentially via programmatic halvings (3.125 BTC → 1.56 BTC → 0.78 BTC → 0).

neg-303 shows: Even with price increases, USD revenue declining because price can’t grow fast enough.

Together they prove: Mining death spiral inevitable from both BTC and USD perspectives.

- BTC perspective: Block rewards approaching zero (programmatic)

- USD perspective: Revenue peaked in 2021, declining despite price ATHs (mathematical)

Both derivatives negative. Both past inflection point. Both prove inevitable mining collapse.

The Fee Market That Didn’t Save Revenue

Bitcoin maximalists claimed: “Don’t worry, transaction fees will replace block rewards.”

Observable reality from revenue data:

2021 peak: $63M/day total revenue = ~$60M block rewards + ~$3M fees (~5% from fees)

2025 current: $47M/day total revenue = ~$53M block rewards + minimal fees (still <10% from fees)

Fees have NOT compensated for block reward decline.

Why fees can’t save revenue:

1. Scaling Limits Proven (gallery-item-neg-302)

Bitcoin frozen at ~7 TPS. Any fee spike → users leave → fees collapse.

2017, 2021, 2023 congestion events: Temporary fee spikes followed by user exodus and collapse back to baseline.

2. Fee Math Doesn’t Work

Current block rewards: 3.125 BTC ≈ $366K per block at $117K BTC

To replace with fees at current 2000-4000 tx/block: $366K / 3000 tx = $122 per transaction average

Users won’t pay $122 fees when Ethereum L2s cost $0.01-0.10.

3. Observable Fee Behavior

Even during 2021 bull market peak (maximum activity):

- Total revenue: $63M/day

- Fee revenue: ~$3M/day (~5%)

- Block reward revenue: ~$60M/day (~95%)

Fees never approached levels needed to replace block rewards, even during peak euphoria.

Post-2024 halving, block rewards cut 50%, fees didn’t double to compensate. Revenue declined.

Mathematical proof fees can’t save miner revenue.

The 2028 Halving Cliff

Current situation (2025):

- Block rewards: 3.125 BTC

- Price: $117K

- Revenue: ~$47M/day

- Down 25% from 2021 peak despite 75% higher price

Post-2028 halving:

- Block rewards: 1.56 BTC (50% cut)

- Optimistic price: $200K (71% increase)

- Projected revenue: 1.56 × $200K × 144 = ~$45M/day

- Still below 2021 peak, and declining

Realistic price: $140K (20% increase - more typical mature asset growth):

- Revenue: 1.56 × $140K × 144 = ~$31.5M/day

- 50% below 2021 peak

- 33% below current levels

2028 halving creates visible cliff in revenue that price growth cannot offset.

Miners currently marginal at $47M/day. At $31.5M/day, large-scale capitulation inevitable.

Comparison To Ethereum

Why Ethereum doesn’t have this problem:

No Emission-Price Treadmill

Ethereum post-merge:

- Proof-of-stake security decoupled from USD revenue

- Validators earn from staking, not continuous energy expenditure

- Security doesn’t require exponentially growing price to offset emission decline

- Issuance can decrease (EIP-1559 burn) without threatening security

Result: No revenue sigmoid death spiral. Security sustainable regardless of USD revenue trends.

Fee Market Actually Works

Ethereum scaling via L2s means fee revenue sustainable:

- Base layer handles security/settlement

- L2s (Arbitrum, Optimism, Base, etc.) handle throughput

- Users don’t flee during congestion - they use L2s

- Fee revenue exists because network provides actual utility

Result: Fee market can sustain validators because actual transaction volume possible.

Observable Contrast

Bitcoin miner revenue: Peaked 2021, declining despite price ATHs, death spiral underway

Ethereum validator revenue: Stable/growing with increasing L2 activity, sustainable security model

The sigmoid chose Ethereum. Bitcoin’s revenue curve is dying.

Why This Matters For Positioning

The USD revenue sigmoid proves mining collapse timing:

Historical pattern:

- Revenue peaked 2021 at $63M/day

- Currently $47M/day despite 75% higher price

- 2028 halving likely brings revenue to $30-45M/day range

- 2032 halving: Sub-$30M/day probable

Miner profitability threshold:

Current global hashrate: ~1,274 EH/s (gallery-item-neg-278)

At $47M/day, marginal miners already unprofitable.

At $30M/day (post-2028), significant hashrate decline inevitable.

The revenue sigmoid provides quantitative timeline for mining collapse.

Not “maybe someday” - specific revenue levels where economics break.

Portfolio implications:

- Mining collapse mathematically scheduled for 2028-2032 window

- Position accordingly with coordination infrastructure (EIGEN, MORPHO, ETHA, stETH)

- Minimal symbolic Bitcoin short proves positioning deliberate

- Let Bitcoin die via its own revenue math

The chart already showed the verdict. Just waiting for market recognition.

The Honest Assessment

Could miner revenue recover to 2021 levels?

Theoretically possible if:

- Bitcoin price hits $140K+ in current epoch (3.125 BTC blocks)

- AND maintains $280K+ after 2028 halving (1.56 BTC blocks)

- AND reaches $560K+ after 2032 halving (0.78 BTC blocks)

- AND continues exponential growth forever

Realistically: No.

Market cap limits make required price growth unrealistic. Bitcoin at $560K = $11T market cap = nearly all gold’s market cap. Bitcoin at $1.1M (needed for 2036) = $22T = implausible.

More likely scenario:

- Bitcoin grows to $150-200K over next 5-10 years (mature asset growth rate)

- Revenue continues declining in real terms due to halvings

- By 2032, revenue <$30M/day makes mining unprofitable for majority of network

- Hashrate decline accelerates

- Security budget crisis becomes obvious

- Network failure risk materializes

The revenue sigmoid already recorded the verdict: Peak passed, derivative negative, permanent decline underway.

Only question: How fast does market recognize what the math already shows?

Conclusion: The Sigmoid Doesn’t Lie

Bitcoin miner revenue in USD forms sigmoid curve that peaked in 2021.

Observable proof:

- 2021 peak: $63M/day at BTC $67K (6.25 BTC blocks)

- 2025 current: $47M/day at BTC $117K (3.125 BTC blocks)

- 75% higher price, 25% lower revenue

Mathematical proof:

- Revenue = Block_Reward × Price

- Block rewards halving exponentially (programmatic)

- Price can’t grow exponentially forever (market cap limits)

- Therefore revenue must decline (derivative negative)

Inflection point passed:

- Peak absolute revenue: 2021

- Peak growth rate: ~2017-2021

- Current: Declining slope despite price ATHs

- Future: Accelerating decline as halvings continue

2028 halving creates visible cliff:

- Even optimistic $200K price → $45M/day revenue (below 2021 peak)

- Realistic $140K price → $31.5M/day revenue (33% decline from now)

- Mining profitability crisis → hashrate collapse → security failure

This isn’t prediction - it’s observation. The revenue data already shows the sigmoid turning downward. We’re watching the death spiral in real-time.

Compare to Ethereum: Proof-of-stake security decoupled from USD revenue. No sigmoid death spiral. Sustainable indefinitely.

The revenue curve chose Ethereum. The sigmoid is killing Bitcoin.

Discovery: Bitcoin miner revenue in USD forms sigmoid curve that peaked at $63 million per day in 2021. Despite Bitcoin price reaching $117,000 in 2025 (75% higher than 2021’s $67,000 peak), daily miner revenue has declined to $47 million (25% lower). This proves the inflection point has passed - price growth can no longer compensate for exponential block reward decline via halvings. 2028 halving will cut revenue to $30-45M/day range, triggering large-scale mining collapse. Revenue derivative permanently negative. Market cap limits prevent required exponential price growth. This is observable reality, not prediction.

#MinerRevenueSigmoid #RevenueInflectionPoint #2021Peak #PriceCanNotCompensate #HalvingDominates #USDRevenue #MiningCollapse #DerivativeNegative #SigmoidProof #ObservableDecline #MarketCapLimits #2028Cliff #EthereumAdvantage #ProgrammaticCollapse #RevenueDeathSpiral #MathematicalProof #BlockRewardDecline #ExponentialImpossible #QuantitativeTimeline #SecurityBudgetCrisis