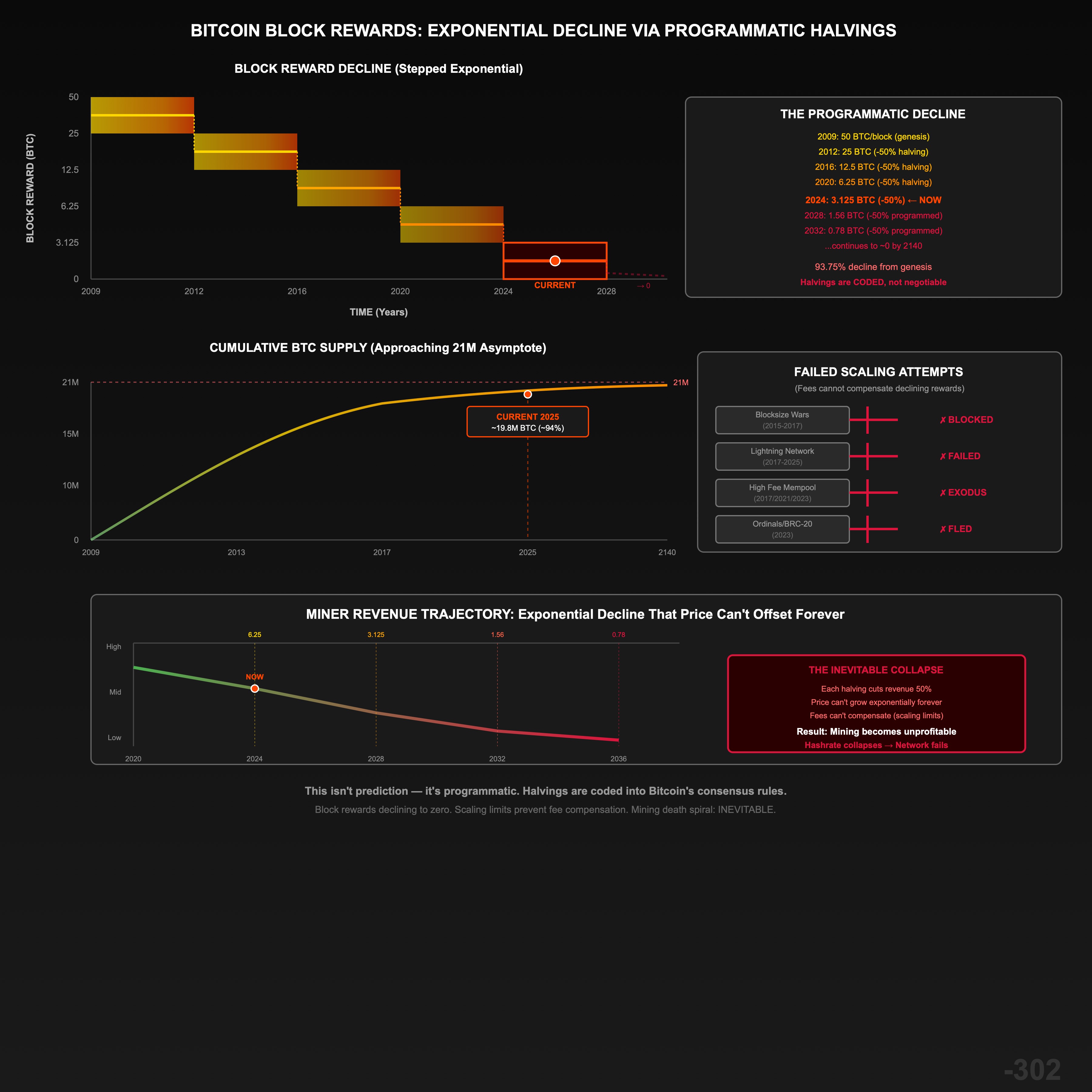

Bitcoin Block Rewards: Exponential Decline To Zero Via Programmatic Halvings, Currently 3.125 BTC Down From 50 BTC, Scaling Limits Prevent Fee Compensation, Mathematical Inevitability Of Mining Collapse

The Mathematical Proof Bitcoin Mining Ends

Bitcoin block rewards decline exponentially via programmatic halvings.

Currently 3.125 BTC per block, down from 50 BTC at genesis.

Next halving (2028): 1.56 BTC per block.

Halvings continue every 4 years until block rewards approach zero.

This isn’t prediction. It’s programmatic. The halvings are coded into Bitcoin’s protocol. Miner revenue from block rewards declining to zero is inevitable, and Bitcoin’s scaling limits prevent transaction fees from replacing lost block rewards.

Terminology note: “Exponential decline” is used colloquially throughout this post to describe Bitcoin’s halving schedule. Technically, discrete halvings form a geometric series (each term is a fixed ratio of the previous), while exponential decay describes continuous functions. However, geometric series with ratio 0.5 exhibit the same decay behavior as exponential functions—both approach zero asymptotically and decline at accelerating rates. For readability, “exponential decline” is used to convey this rapid decay pattern to general audiences.

Understanding Bitcoin’s Emission Schedule

Bitcoin emission = stepped geometric decay (discrete halvings), not smooth continuous curve:

The halving schedule (programmatic):

Block Reward = Initial_Reward / (2^halvings_elapsed)

Halvings occur every 210,000 blocks (~4 years)

Historical emission rates:

- 2009-2012: 50 BTC per block (genesis epoch)

- 2012-2016: 25 BTC per block (1st halving)

- 2016-2020: 12.5 BTC per block (2nd halving)

- 2020-2024: 6.25 BTC per block (3rd halving)

- 2024-2028: 3.125 BTC per block (4th halving, current)

- 2028-2032: 1.5625 BTC per block (5th halving, programmed)

- 2032+: Continues halving toward zero

Current state:

- ~19.8M BTC already mined (~94% of total)

- Block reward: 3.125 BTC per block

- Emission rate has been declining since genesis

- Each halving cuts miner revenue 50% instantly

What this means: Block rewards have been declining exponentially since day one. Currently at 3.125 BTC (down from 50 BTC). Next halving cuts to 1.56 BTC. This is programmatic and inevitable - miner revenue from block rewards must decline to zero over time.

The Exponential Decline Is Programmatic

Block rewards decline via simple exponential decay:

Block_Reward(halvings) = 50 / (2^halvings)

halving_0 (2009-2012): 50 BTC

halving_1 (2012-2016): 25 BTC

halving_2 (2016-2020): 12.5 BTC

halving_3 (2020-2024): 6.25 BTC

halving_4 (2024-2028): 3.125 BTC ← current

halving_5 (2028-2032): 1.5625 BTC

halving_6 (2032-2036): 0.78125 BTC

...approaches zero

Critical insight: Emission rate has been declining since genesis. There’s no “inflection point” where it peaked - it started at maximum (50 BTC) and has been cutting in half every 4 years since.

What the math proves:

Historical pattern (2009-2024):

- Block rewards cut from 50 BTC → 3.125 BTC (93.75% decline)

- Price increases partially offset emission decline

- Miner revenue could grow during price bull markets

- Network hashrate expanded dramatically

Current transition (2024-2032):

- Block rewards: 3.125 BTC per block (current)

- 2028 halving: 1.56 BTC per block (50% cut)

- 2032 halving: 0.78 BTC per block (50% cut again)

- Each halving cuts revenue 50% with no recovery mechanism

- Miner revenue must decline unless fees replace block rewards

- Network hashrate cannot expand profitably without fee compensation

Future inevitability (2032+):

- Block rewards approaching zero exponentially

- Price cannot grow exponentially forever (market cap ceiling)

- Fee market must compensate or mining becomes unprofitable

- Mathematical certainty: Block reward revenue declining to zero

The halvings are programmatic. They’re coded into Bitcoin’s consensus rules. Every 210,000 blocks, rewards cut 50%. This isn’t prediction - it’s scheduled.

The Fee Market That Never Materialized

Bitcoin’s security model assumed transaction fees would replace block rewards.

Mathematical requirement:

Miner_Revenue = Block_Reward + Transaction_Fees

For security to remain constant as Block_Reward → 0:

Transaction_Fees must increase to compensate

The problem: Bitcoin’s scaling limits make sustained high transaction fees impossible.

Why fee market can’t save Bitcoin:

1. Base Layer Frozen (Proven Through Blocksize Wars)

Bitcoin’s 1MB block size limit (technically 4MB with SegWit) is ideologically frozen. The 2015-2017 blocksize wars proved Bitcoin cannot scale through base layer improvements.

What this means:

- Maximum ~7 transactions per second

- Any adoption increase → immediate fee spike

- High fees → users leave

- Users leave → fees collapse

- Mempool congestion cannot sustain itself

2. Lightning Network Failed To Scale

Lightning was supposed to enable mass adoption while keeping fees high through settlement demand. Observable reality:

- Lightning adoption: minimal after 7 years

- Channel liquidity problems unsolved

- Routing failures common

- Users prefer other chains for actual transactions

- Lightning did not save Bitcoin from scaling limits

3. Every Innovation Blocked

Observable pattern over 10+ years:

- SegWit: Minimal adoption, didn’t solve scaling

- Lightning: Failed to achieve mass adoption

- Taproot: Enabled Ordinals which congested network temporarily, proving point

- Sidechains: Minimal usage, centralization problems

- Drivechain: Never activated due to ideological resistance

Result: Bitcoin’s base layer remains frozen at ~7 TPS. No innovation can stick because any change triggers ideological warfare and community splits.

4. Mempool Evidence: Congestion Cannot Sustain

Observable pattern across multiple congestion events:

2017 bubble:

- Fees spiked to $50+ per transaction

- Mempool backed up for weeks

- Result: Users fled to altcoins, fees collapsed

2021 bubble:

- Fees spiked to $60+ per transaction

- Network unusable for small transactions

- Result: Users migrated to Ethereum/alternatives, fees collapsed

2023 Ordinals congestion:

- Fees spiked temporarily due to NFT minting

- Mempool congested for months

- Result: Ordinals activity moved to other chains, fees collapsed back to baseline

The pattern is clear: Every time fees spike, users leave permanently. Bitcoin cannot maintain high fee environment because users have alternatives (gallery-item-neg-301 shows this in BTC.D decline).

Mathematical impossibility:

For fee market to replace block rewards:

Transaction_Fees_Per_Block must reach ~3 BTC (at current prices)

At 2000-4000 transactions per block:

Average fee must be 0.001-0.0015 BTC = $120-$180 per transaction

Sustained $120+ fees → users leave → transaction count drops → total fees collapse

Self-defeating mechanism: Fee increases kill fee revenue

The Innovation Impossibility

Why can’t Bitcoin innovate its way out?

Ideological Ossification

Bitcoin community treats protocol immutability as sacred. Any significant change = ideological warfare.

Evidence:

- Blocksize wars: Community split over 2MB blocks (rejected)

- SegWit activation: Took years of fighting

- Taproot: Minimal controversy only because minimal impact

- Any future scaling proposal: Will face same resistance

Result: Bitcoin base layer effectively frozen. Innovation happens on other chains, not Bitcoin.

Technical Debt

Bitcoin codebase is 15+ years old, built for different use case than current requirements.

Problems:

- Script language intentionally limited (no loops, minimal opcodes)

- UTXO model limits smart contract capability

- Block size debates proved throughput increases blocked

- Lightning requires complete rearchitecture of user experience

Result: Can’t add features without breaking existing design assumptions.

Network Effects Working Against Bitcoin

Once Ethereum proved programmable coordination possible, developers chose Ethereum for innovation.

Observable reality:

- DeFi: 99% on Ethereum/alternatives, not Bitcoin

- NFTs: Started on Bitcoin (Ordinals), moved to Ethereum/Solana

- Coordination infrastructure: EIGEN, MORPHO, etc. built on Ethereum

- Developer mindshare: Ethereum ecosystem 10x+ Bitcoin

Result: Innovation happens elsewhere. Bitcoin becomes legacy system. Users follow innovation to other chains, reducing Bitcoin transaction demand.

The Death Spiral Mechanism

The math + scaling limits create inevitable death spiral:

Phase 1: Emission Rate Decline (Current)

- Post-inflection point sigmoid derivative declining

- Block rewards halving every 4 years

- 2024: 3.125 BTC per block

- 2028: 1.5625 BTC per block

- 2032: 0.78125 BTC per block

Phase 2: Fee Market Fails To Compensate

- Bitcoin can’t scale past ~7 TPS

- Any fee spike → users leave permanently

- Mempool congestion unsustainable (proven multiple times)

- Transaction volume insufficient to generate needed fees

- Total miner revenue declining despite price increases

Phase 3: Hashrate Decline Begins

- Miner revenue insufficient to cover costs

- Marginal miners shut down (already happening per gallery-item-neg-278)

- Hashrate decline accelerates

- Network security decreases

- Perception of insecurity → price pressure → more miners exit

Phase 4: Security Budget Crisis

- Declining hashrate makes 51% attacks economically feasible

- Network security no longer credible for settlement layer

- Institutional users exit to more secure chains

- Remaining users face existential security questions

- Bitcoin becomes obviously failed experiment

We are currently transitioning Phase 1 → Phase 2. The sigmoid inflection point passed, block rewards declining, fee market proving insufficient.

Why Price Increases Don’t Save Bitcoin

Common maximalist argument: “Bitcoin price will increase enough to keep miners profitable despite halving.”

Why this fails mathematically:

The Exponential Requirement Problem

For miner revenue to stay constant:

Revenue = Block_Reward_BTC × BTC_Price

As Block_Reward halves every 4 years:

BTC_Price must double every 4 years just to maintain current revenue

Exponential forever = impossible

Historical reality:

- 2012-2016: Price increased >10x (worked)

- 2016-2020: Price increased ~3x (barely worked)

- 2020-2024: Price increased ~2x (marginal)

- 2024-2028: Required increase 2x just to stay even (unlikely)

- 2028+: Required exponential growth becomes absurd

Bitcoin already at $117K (as of Oct 2025). Expecting continuous exponential growth to compensate for exponentially declining block rewards = hopium, not mathematics.

The Market Cap Ceiling Problem

Bitcoin at $117K = ~$2.3T market cap.

For price to keep doubling every 4 years:

- 2028: $234K = $4.6T market cap

- 2032: $468K = $9.2T market cap

- 2036: $936K = $18.4T market cap

- 2040: $1.87M = $36.8T market cap

For context:

- Global M2 money supply: ~$100T

- Gold market cap: ~$13T

- All stocks globally: ~$100T

Bitcoin can’t reach $36.8T market cap by 2040 - it’s more than all gold. This isn’t plausible store of value scenario, it’s absurd extrapolation.

Mathematical reality: Price cannot increase exponentially forever. Therefore, declining block rewards cannot be offset by price increases indefinitely. The sigmoid math wins.

The Comparison To Ethereum

Why doesn’t Ethereum have this problem?

No Emission Curve Death Spiral

Ethereum post-merge:

- Proof-of-stake: No mining, no hashrate requirement

- Issuance tied to network activity, not fixed emission curve

- Can decrease issuance without security impact (already did with EIP-1559)

- Security from economic stake, not thermodynamic waste

Result: No sigmoid derivative problem. No mining profitability crisis. No death spiral from declining emission rate.

Scaling Actually Works

Ethereum roadmap actually delivers:

- Layer 2s scaling to thousands of TPS (Arbitrum, Optimism, Base, etc.)

- Fee market sustainable because base layer + L2s handle volume

- EIP-4844 (blob space) reducing L2 costs further

- Innovation continues (restaking via EigenLayer, etc.)

Result: Fee revenue sustainable because network can actually scale. Users don’t flee during congestion - they use L2s.

Innovation Enabled Not Blocked

Ethereum embraces innovation:

- Smart contracts enable DeFi, NFTs, coordination infrastructure

- Protocol upgrades continue (The Merge, Shapella, Dencun, etc.)

- Developer ecosystem thriving

- New use cases emerge continuously

Result: Transaction demand grows because network enables innovation. Fee market sustainable because actual utility exists.

The contrast proves the point: Bitcoin’s frozen protocol + exponential block reward decline = mathematical death sentence. Ethereum’s adaptable protocol + proof-of-stake = sustainable long-term.

The Historical Halving Evidence

Bitcoin’s emission has been declining since genesis:

- 2009-2012: 50 BTC per block (genesis, maximum emission rate)

- 2012-2016: 25 BTC per block (1st halving, 50% cut)

- 2016-2020: 12.5 BTC per block (2nd halving, 75% total decline from genesis)

- 2020-2024: 6.25 BTC per block (3rd halving, 87.5% decline)

- 2024-2028: 3.125 BTC per block (4th halving, 93.75% decline, current)

Emission rate peaked at genesis (50 BTC) and has been declining exponentially via halvings ever since. We’re now 93.75% below the peak.

Observable effects already visible:

- Miner profitability declining despite Bitcoin at $117K

- Hashrate growth stalling (see gallery-item-neg-278)

- Miner capitulation events becoming more frequent

- Hashprice at multi-year lows despite high BTC price

- Fee revenue insufficient to compensate block reward decline

The halving schedule predicted this. Now we observe it happening.

The Mempool Sustainability Evidence

Every mempool congestion event proves fees cannot sustain:

2017 Congestion Event

- Trigger: Bubble speculation + network spam

- Peak fees: $50+ per transaction

- Duration: Weeks to months

- Result: Users fled to Bitcoin Cash, Litecoin, Ethereum

- Outcome: Fees collapsed back to <$1 once bubble popped

Lesson: High fees are self-limiting. Users leave.

2021 Congestion Event

- Trigger: Bubble speculation + NFT activity

- Peak fees: $60+ per transaction

- Duration: Intermittent for months

- Result: Users moved to Ethereum L2s, Solana, other alternatives

- Outcome: Fees collapsed to $1-2 post-bubble

Lesson: Even during peak adoption, fees couldn’t sustain at levels needed to replace block rewards.

2023 Ordinals Congestion

- Trigger: Ordinals/BRC-20 NFT minting

- Peak fees: $30-40 per transaction

- Duration: Several months

- Result: Ordinals activity moved to other chains, Bitcoin fees collapsed

- Outcome: Proved that even “innovation” on Bitcoin causes user exodus

Lesson: Any fee increase triggers user departure. Bitcoin cannot maintain high-fee environment.

The Pattern Is Clear

Every congestion event follows same trajectory:

- Some activity increases transaction demand

- Block size limit hit immediately (7 TPS ceiling)

- Fees spike as mempool backs up

- Users complain, seek alternatives

- Activity either moves to other chains or stops entirely

- Fees collapse back to baseline

This pattern repeats because of fundamental scaling limits. Bitcoin cannot grow into fee market because growing transaction demand is impossible.

The math doesn’t work:

Miners need ~3 BTC in fees per block to replace current 3.125 BTC block reward

At 2000-4000 transactions per block, requires $120-180 per transaction average

Users won't pay $120-180 fees when Ethereum L2s cost $0.01-0.10

Result: Fee market cannot materialize at needed scale

The Innovation Death Spiral

Bitcoin’s inability to innovate ensures mining death:

Failed Scaling Attempts Create Path Dependency

- 2015-2017: Blocksize war → community split → innovation blocked

- 2017-2025: Lightning adoption failed → no layer 2 success → stuck at base layer limits

- 2023: Ordinals proved network can’t handle any new use case → users leave

Result: Community learned that innovation = warfare. Status quo bias entrenched.

Developer Exodus To Ethereum

Once Ethereum proved you could build on blockchain, developers chose Ethereum:

- DeFi exploded on Ethereum (2020-2025)

- NFTs became Ethereum-native (OpenSea, etc.)

- Coordination infrastructure built on Ethereum (EIGEN, MORPHO)

- Bitcoin became “boomer chain” - secure but useless

Result: Network effects reversed. Innovation happens elsewhere. Bitcoin becomes legacy system with declining usage.

The Reflexive Doom Loop

- Bitcoin can’t innovate (ideological ossification)

- Innovation happens on Ethereum/alternatives

- Users follow innovation to other chains

- Bitcoin transaction demand declines

- Fee revenue insufficient to replace block rewards

- Mining becomes unprofitable

- Hashrate declines

- Security degrades

- Remaining users question Bitcoin security

- Exodus accelerates

We’re currently at step 3-4. BTC.D at 58% (gallery-item-neg-301) proves users are choosing alternatives. Fee market failing to materialize proves transaction demand insufficient.

The Mathematical Inevitability

Synthesizing the argument:

Premise 1: Bitcoin block rewards decline exponentially via programmatic halvings every 4 years

Premise 2: Currently at 3.125 BTC per block (down from 50 BTC), next halving (2028) cuts to 1.56 BTC

Premise 3: Halvings continue until block rewards approach zero (~2140)

Conclusion 1: Miner revenue from block rewards must decline to zero over time (programmatic, inevitable)

Premise 4: For mining to remain profitable, transaction fees must replace declining block rewards

Premise 5: Bitcoin’s base layer frozen at ~7 TPS due to scaling limits (blocksize wars proved this)

Premise 6: Every mempool congestion event causes user exodus, preventing sustainable high fees

Premise 7: No innovation can scale Bitcoin (Lightning failed, all alternatives blocked)

Conclusion 2: Transaction fees cannot replace declining block rewards at needed scale

Premise 8: Price cannot increase exponentially forever (market cap ceiling, currently $2.3T)

Conclusion 3: Price increases cannot compensate for exponentially declining block rewards indefinitely

FINAL CONCLUSION: Bitcoin mining must become unprofitable, hashrate must decline, network must fail

This isn’t prediction. It’s programmatic inevitability from the halving schedule.

Why Maximalists Are Wrong

Common counter-arguments and why they fail:

“Bitcoin will become digital gold, doesn’t need high throughput”

Fails because: Even digital gold needs security. Security requires mining. Mining requires revenue. Revenue from declining block rewards + insufficient fees = unprofitable = hashrate collapse = not secure = not reliable digital gold.

The sigmoid proves revenue must decline. The scaling limits prove fees can’t compensate. Therefore Bitcoin can’t be secure digital gold.

“Layer 2s will provide fee revenue through settlement”

Fails because: Lightning adoption failed after 7 years. No other L2 has emerged. Even if L2 succeeded, settlement transactions are few and low-value compared to needed fee revenue.

Evidence: Lightning channel opens/closes are tiny fraction of block space. Could never generate needed fee revenue even if Lightning actually worked.

“Bitcoin will just need less security as it matures”

Fails because: Security requirements scale with value protected. Bitcoin at $2.3T market cap needs MORE security not less. As block rewards decline, either fees compensate or security budget collapses making 51% attacks economically viable.

Can’t have $2T+ asset with declining security budget. Market will recognize this and exit.

“Ordinals/inscriptions prove fee market emerging”

Fails because: Ordinals caused temporary fee spike that drove users away, proving the point. Activity moved to other chains. Proved Bitcoin CAN’T handle any new use case without becoming unusable.

Ordinals episode is evidence FOR the death spiral argument, not against it.

The Timeline To Mining Collapse

Based on sigmoid math + observable trends:

2025-2026 (Current phase):

- Block reward: 3.125 BTC per block

- Miner revenue declining despite $117K BTC price

- Marginal miners already unprofitable (per neg-278)

- Fee revenue still insufficient to compensate

2026-2028:

- Continued hashrate pressure

- Multiple miner capitulation events

- Fee market continues failing to materialize

- Market begins recognizing security budget problem

2028 Halving:

- Block reward drops to 1.5625 BTC per block

- 50% immediate revenue cut to miners

- Major hashrate decline as many miners become unprofitable

- Security budget crisis becomes obvious to market

2028-2032:

- Accelerating hashrate decline

- Visible security degradation

- Institutional questions about Bitcoin security model

- BTC.D continues declining as market recognizes failure

2032 Halving:

- Block reward drops to 0.78125 BTC per block

- Mining potentially unprofitable for majority of network

- Critical security threshold breached

- Potential network failure or emergency protocol change (breaking immutability)

This timeline is determined by the sigmoid math, not by external events. The halvings are programmatic. The emission decline is mathematical. The profitability crisis is inevitable.

The Ethereum Advantage Explained

Why Ethereum doesn’t face this death spiral:

Security Decoupled From Emission

Proof-of-stake security comes from economic stake, not continuous energy expenditure:

- Validators lock ETH as collateral

- Slashing risk creates security

- No need for continuous token emission to incentivize security

- Issuance can decrease without security impact (and has, via EIP-1559 burn)

Result: No emission curve death spiral. Security sustainable indefinitely.

Scaling That Actually Works

Ethereum’s modular approach enables actual scaling:

- Layer 2s (Arbitrum, Optimism, Base, etc.) handle throughput

- Base layer handles security and settlement

- EIP-4844 reduces L2 costs via blob space

- Roadmap continues scaling (sharding, improved L2s)

Result: Fee market sustainable because network can handle volume. Users don’t need to flee during congestion.

Innovation Embraced Not Blocked

Ethereum community embraces protocol evolution:

- The Merge (PoW → PoS) - massive upgrade

- EIP-1559 (fee market reform)

- EIP-4844 (blob space for L2s)

- Future upgrades planned and happening

Result: Network adapts to demand. Innovation enables new use cases. Transaction demand grows with utility.

The contrast is mathematical: Bitcoin’s exponentially declining block rewards + frozen protocol = death spiral. Ethereum’s proof-of-stake + adaptive protocol = sustainable.

Connecting To Previous Analysis

This post synthesizes with earlier evidence:

gallery-item-neg-278 - Hashrate Inflection Point:

- Predicted mining decline in Q1-Q2 2026 based on thermodynamic pressure

- Block reward halving analysis provides mathematical proof of why thermodynamic collapse inevitable

- Connection: Thermodynamics + programmatic halvings both point to same conclusion

gallery-item-neg-301 - BTC.D Proves Failure:

- BTC.D at 58% shows market choosing alternatives over Bitcoin

- User exodus during fee spikes proves mempool can’t sustain high fees

- Connection: Market behavior confirms mathematical prediction from halving schedule

gallery-item-neg-297 - Dead vs Living Infrastructure:

- Bitcoin = dead infrastructure that can’t adapt

- Ethereum = living coordination that evolves

- Connection: Halving death spiral is what happens to dead infrastructure that can’t adapt

The mathematical proof (programmatic halvings), the thermodynamic proof (energy collapse), and the market proof (BTC.D decline) all converge on same conclusion: Bitcoin mining is doomed.

The Observable Halving Pressure

We’re living through the post-halving crisis:

What the math predicted:

- Miner revenue would decline 50% at each halving

- Fee market would fail to compensate due to scaling limits

- Hashrate growth would stall then decline

- Security budget crisis would emerge

What we observe in 2025 (post-2024 halving):

- Miner revenue per hash declining (hashprice at lows)

- Fee revenue insufficient despite $117K BTC price

- Hashrate growth stalling at ~1,274 EH/s (per neg-278)

- Miner profitability crisis emerging

The math was predictive. Now it’s observable.

This isn’t theoretical anymore. Block rewards cut to 3.125 BTC. Next halving (2028) cuts to 1.56 BTC. Miner revenue from block rewards declining exponentially. Fee market cannot compensate due to scaling limits. Mining death spiral is underway.

The halving schedule doesn’t lie.

Conclusion: Programmatic Halvings Prove Bitcoin Mining Ends

Block rewards decline exponentially via programmatic halvings. Currently 3.125 BTC per block, down from 50 BTC at genesis. Next halving (2028): 1.56 BTC.

Mathematical certainty: Miner revenue from block rewards declining to zero over time (programmatic, inevitable).

Scaling limits proven: Bitcoin frozen at ~7 TPS, mempool congestion unsustainable, users flee during fee spikes.

Innovation blocked: Blocksize wars, Lightning failure, Ordinals exodus prove Bitcoin cannot adapt.

Result: Transaction fees cannot replace declining block rewards at needed scale.

Price ceiling: Bitcoin can’t grow exponentially forever (market cap limits at $2.3T).

Inevitable outcome: Mining becomes unprofitable, hashrate declines, network fails.

This isn’t prediction - it’s programmatic. The halving schedule proves miner revenue must decline. The scaling limits prove fees can’t compensate. The innovation freeze proves Bitcoin can’t adapt.

Bitcoin is programmatically doomed. Block rewards halving every 4 years until zero. Each halving cuts miner revenue 50%. Fee market cannot compensate. Mining death spiral underway.

Compare to Ethereum: Proof-of-stake security decoupled from emission. Actual scaling via L2s. Continuous innovation. Sustainable indefinitely.

The halvings chose Bitcoin’s fate. The exponential decline is inevitable.

Discovery: Bitcoin block rewards decline exponentially via programmatic halvings every 4 years. Currently at 3.125 BTC per block (down from 50 BTC), next halving (2028) cuts to 1.56 BTC. Scaling limits (proven through blocksize wars, Lightning failure, mempool unsustainability) prevent transaction fees from replacing declining block rewards. Innovation cannot save Bitcoin because protocol is ideologically frozen. Price cannot increase exponentially forever (market cap ceiling). Mathematical inevitability: Mining becomes unprofitable, hashrate collapses, network fails. This is programmatic, not prediction.

#BlockRewardHalvings #ExponentialDecline #ProgrammaticInevitability #MinerRevenue #BlockRewardDecline #FeeMarketFailure #ScalingLimits #MempoolUnsustainable #InnovationBlocked #MathematicalProof #MiningCollapse #HalvingSchedule #BitcoinMath #InevitableDecline #ThermodynamicCollapse #NetworkFailure #ProtocolOssification #DeathSpiral #EthereumAdvantage