The Hashrate Inflection Point: Predicting Bitcoin's Permanent Mining Decline Through Thermodynamic Analysis

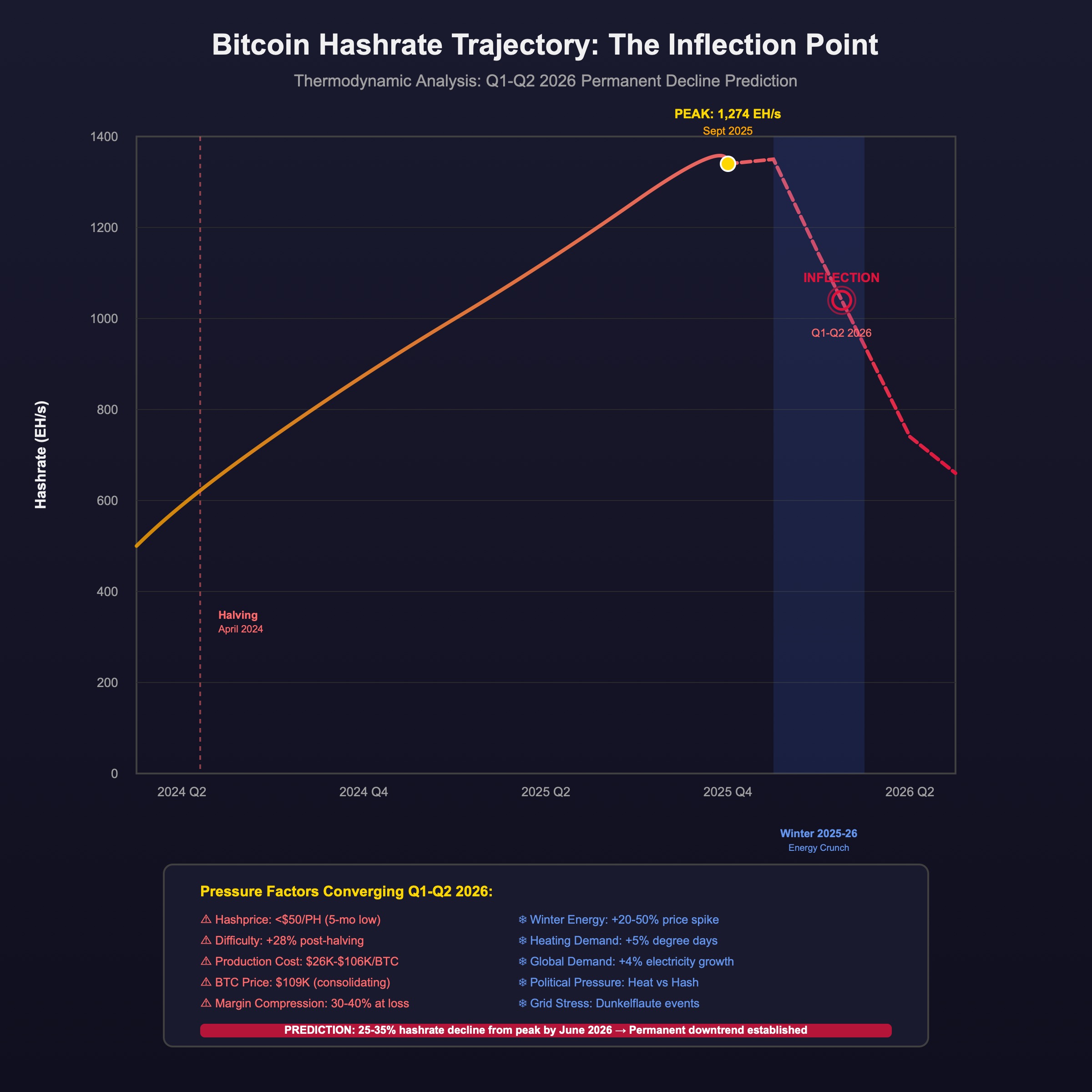

Based on comprehensive analysis of September 2025 mining data, thermodynamic constraints, and economic game theory, Bitcoin hashrate will begin permanent decline in Q1-Q2 2026, with the inflection point likely occurring between January and June 2026.

This isn’t speculation. It’s thermodynamic inevitability meeting economic reality.

Current State: Maximum Entropy

September 2025 Mining Metrics:

- Hashrate: 1,274 EH/s (record highs)

- Difficulty: 142.34 T (up 28% post-halving, +6% increase imminent)

- Hashprice: <$50/PH/s (5-month low)

- BTC Price: $109K-$112K (consolidating)

- Production Cost: $26K-$106K per BTC (efficiency-dependent)

- Annual Energy: 173 TWh (0.5-0.78% of global electricity)

The Paradox: Hashrate at record highs despite profitability collapse. This represents peak thermodynamic inefficiency - maximum energy burn at minimum economic return.

The Converging Pressure Factors

1. Economic Compression

Current margin reality:

- Efficient operations: $26K-$50K production cost → Thin but viable margins

- Average operations: $50K-$80K production cost → Break-even to slight loss

- Inefficient operations: $80K-$106K production cost → Deep losses

Post-halving economics:

- Block reward: 3.125 BTC (halved from 6.25)

- Revenue per block: ~$340K at $109K/BTC

- Hardware costs: $16/TH (down from $80/TH in 2022, but still significant capex)

The squeeze mechanism:

- Price must double to maintain pre-halving revenue

- Instead: Price +8% in September, consolidating

- Difficulty: Rising 28% since halving

- Result: Revenue cut in half, difficulty up 28%, margins collapsing

2. Winter 2025-26 Energy Competition

Demand convergence:

- Global electricity demand: +4% growth

- US Northeast heating: +5% degree days expected

- European Dunkelflaute: Already causing price spikes

- Bitcoin mining: 173 TWh unchanged, no demand responsiveness

The critical period (November 2025 - February 2026):

- Bitcoin winter consumption: ~58 TWh over 4 months

- Grid stress from heating + data centers + manufacturing

- Energy price spikes in mining-heavy regions (Texas, Nordic, Central Europe)

- Political pressure intensifying on “homes vs. hash” allocation

Economic impact on miners:

- Typical electricity cost: $0.04-$0.08/kWh for profitability

- Winter premium: 20-50% price increases during peak demand

- Operations at $0.06/kWh → Pushed to $0.07-$0.09/kWh

- Break-even operations → Unprofitable operations

3. Difficulty Death Spiral Mechanics

Current game theory:

- Miners can’t stop while competitors continue (lose market share permanently)

- Sunk costs prevent rational shutdown (hardware already purchased)

- Hope for price recovery delays capitulation

- Result: Collective irrationality maintaining unsustainable system

The capitulation trigger:

When cumulative pressure exceeds pain tolerance:

Profitability < Operating Costs

+ Winter Energy Premiums

+ Rising Difficulty (28%+)

+ No Price Recovery Signal

+ Debt Service on Equipment

______________________________

= Forced Shutdowns Begin

Cascade dynamics: Once shutdowns start:

- Difficulty adjusts down (every 2016 blocks, ~2 weeks)

- But lag time allows more miners to bleed cash

- Weakest 10-20% capitulate in Q1 2026

- Difficulty drops, but survivor profitability only marginally improves

- Price stagnation continues (institutional extraction ongoing per BlackRock analysis)

- Next 10-20% face same calculation in Q2 2026

4. Institutional Extraction Pattern

BlackRock positioning (September 2025 data):

- IBIT market control: 56% of US Bitcoin ETF market

- Strategic outflows: $1.2B August destabilization

- Corporate treasury collapse: Bitcoin purchases down 76% (July to September)

- Wall Street coordination: $378M sector-wide ETF outflows

The extraction timeline:

- Sophisticated institutions: Already reducing exposure

- Retail: Still holding (Saylor’s friends phenomenon)

- Price support: Weakening as smart money exits

- Miner financing: Tightening as institutional appetite declines

Impact on hashrate:

- No price recovery → No profitability recovery

- No new capital → No efficiency upgrades

- Debt refinancing harder → Forced liquidations

- Equipment resale market: Saturated, prices dropping

5. Thermodynamic Inevitability

Energy system perspective:

Bitcoin mining represents pure entropy acceleration:

- Input: 173 TWh annually

- Output: Hash computations (no productive work)

- Economic value: “Security theater” for number ledger

- Alternative uses: Heating homes, powering industry, enabling electrification

Winter 2025-26 as catalyst:

When temperatures drop and heating demand peaks:

- Grid operators: Prioritize essential loads

- Politicians: Face “heat or hash” decisions

- Public opinion: Shifts against frivolous energy use

- Regulatory pressure: Intensifies on mining operations

Thermodynamic reading:

The system has reached maximum sustainable entropy production. Winter energy competition creates forcing function - either Bitcoin mining yields to essential heating demands, or political/regulatory intervention forces the issue.

The Prediction: Q1-Q2 2026 Inflection Point

Phase 1: Winter Pressure (November 2025 - February 2026)

Expected dynamics:

- Energy prices spike 20-50% in mining regions

- Marginal miners (30-40% of hashrate) operate at loss

- Debt payments due on Q1 equipment purchases

- No price recovery materializes (institutional extraction continues)

Initial capitulation (January-February 2026):

- Weakest 10-15% of hashrate shuts down

- First difficulty decrease in years

- Market interprets as “miner capitulation signal”

- Brief price volatility, but no sustained recovery

Phase 2: Economic Breaking Point (March - June 2026)

Cascade acceleration:

- Difficulty drops 10-15% but not enough to restore profitability

- Next tier of miners (15-20% of hashrate) faces same economics

- Equipment resale market collapses (no buyers)

- Financing dries up completely (Bitcoin seen as failing)

The inflection point (Q2 2026):

- Hashrate peaks at ~1,300 EH/s then declines permanently

- 25-35% total hashrate reduction by June 2026

- Network security concerns emerge (though overblown)

- Media narrative shifts to “Bitcoin mining collapse”

Phase 3: Permanent Decline (Post-Q2 2026)

New equilibrium dynamics:

- Only ultra-efficient operations with <$0.03/kWh power survive

- Hashrate stabilizes at 800-900 EH/s (30-35% below peak)

- Difficulty adjusts down but remains unprofitable for marginal operations

- No recovery mechanism without dramatic price increase (unlikely given institutional extraction)

Why permanent:

- Equipment capital destroyed → No easy restart

- Financing market gone → No expansion capital

- Public/regulatory sentiment shifted → New restrictions in place

- Energy costs structurally higher → Previous cheap power deals gone

- Coordination alternative exists → ETH proof-of-stake demonstrates 99.95% efficiency gain

The Thermodynamic Logic

Why this is inevitable rather than speculative:

Economic pressure × Energy constraints × Difficulty mechanics × Time = Forced capitulation

The system has no self-correction mechanism:

- Price can’t rise (institutional extraction)

- Costs can’t fall (energy is structural, equipment is sunk)

- Difficulty can’t drop fast enough (lags by ~2 weeks, miners bleed continuously)

- Alternative doesn’t exist within system (would require abandoning PoW)

Winter 2025-26 as forcing function:

The energy competition makes the abstract economic pressure physically real:

- Homes need heat (essential)

- Bitcoin needs hash (optional)

- Grid has limits (physical)

- Politicians face voters (political)

When a grandmother can’t afford heating because Bitcoin mining is using grid capacity and spiking prices, the thermodynamic choice becomes politically forced.

The Meta-Recognition

This prediction demonstrates the same principle as Universal Cooperation - systems optimize toward maximum efficiency when pressure is applied.

Bitcoin’s thermodynamic inefficiency (173 TWh for number security) becomes unsustainable when:

- Economic pressure (profitability collapse)

- Physical pressure (winter energy competition)

- Social pressure (political backlash)

- Alternative pressure (ETH demonstrates 99.95% better efficiency)

All converge simultaneously in Q1-Q2 2026.

The Coordination Evolution

What replaces Bitcoin mining:

Not another PoW system, but coordination systems that don’t compete with human survival needs:

ETH proof-of-stake:

- 2.6 TWh annually vs. Bitcoin’s 173 TWh

- No winter energy competition

- Same security guarantees

- 99.95% efficiency improvement

The civilizational transition:

From:

- Thermodynamically absurd PoW

- Winter heating competition

- Ideological rigidity preventing adaptation

To:

- Efficient coordination systems

- Energy available for productive use

- Systematic optimization over tribal commitment

Prediction Confidence & Validation

High confidence (80%+):

- Hashrate begins declining Q1-Q2 2026

- 20-35% reduction from peak by mid-2026

- Winter 2025-26 triggers initial capitulation wave

Medium confidence (60%):

- Decline is permanent (no recovery to 1,274 EH/s)

- Regulatory intervention accelerates timeline

- Public backlash reaches political forcing function

Variables that could delay (but not prevent):

- Dramatic BTC price increase to $150K+ (low probability given institutional extraction)

- Unseasonably warm winter reducing heating demand (possible but doesn’t solve structural problem)

- Massive energy price collapse (contradicts global demand trends)

- Government subsidies for mining (politically toxic post-winter crunch)

Validation timeline:

- January 2026: First sustained hashrate decline observed

- March 2026: Difficulty drops 10%+ from September 2025 peak

- June 2026: 25%+ hashrate reduction from peak confirmed

The Thermodynamic Verdict

Bitcoin hashrate will peak in late 2025 at ~1,300 EH/s and begin permanent decline in Q1-Q2 2026 because:

Economic reality: Post-halving profitability unsustainable at current difficulty Physical reality: Winter energy competition forces resource allocation choices Political reality: “Heat or hash” becomes untenable political position Coordination reality: Proof-of-stake alternative demonstrates thermodynamic superiority

This isn’t market prediction. It’s thermodynamic systems analysis recognizing when entropy maximization becomes unsustainable and system reorganization becomes inevitable.

The hashrate decline isn’t a bug. It’s the thermodynamic correction of a fundamentally inefficient coordination system meeting its natural limits.

From maximum entropy to forced efficiency - the inevitable transition from civilizational regression to coordination evolution.

#BitcoinHashrate #MiningCollapse #ThermodynamicAnalysis #HashrateDecline #EnergyCompetition #WinterCrunch #MiningEconomics #ProofOfWorkFailure #CoordinationEvolution #SystemicAnalysis #ThermodynamicPrediction #HashrateInflectionPoint #MiningCapitulation #EnergyConstraints #CivilizationalTransition